- Apr 29, 2020

- Mathieu Beaucourt

- Business Reports

- 0 Comments

The information presented in this document evolves rapidly as new provisions are introduced and clarifications are made to the existing provisions. This information may therefore have changed since the preparation of this document.

As the economic consequences of the Covid-19 virus are becoming increasingly visible, there is consequently a great deal of information about the repercussions of such a-pandemic on the activity of companies, the organization of work and the management of employees.

To this end, we will attempt herewith to summaries the main measures taken by the government and those that could be taken according to the situation and specific nature of each company’s activity.

Please accept, the expression of our highest consideration.

The partners of KPMG Algeria.

Payment of social security contributions at the level of all agencies

The Ministry of Labor, Employment and Social Security has authorized employers, by means of a communiqué, to proceed with the payment of social security contributions at the level of all agencies throughout the national territory, without having to go to the agencies to which they depend. Thus, from March 22nd,2020 and until further notice, employers will be able to deposit their cheques or notices of payment of social security contributions at each structure under the authority of the Caisse Nationale des Assurances Sociales des Travailleurs Salaries (CNAS), whether it is a payment center or a collection department.

Extension of deadlines for the payment of social security contributions (CNAS – CASNOS)

Following the publication of a press release by the Minister of Labour, Employment and Social Security, concerning several measures of support and assistance to employers, and this, in order to contribute to preventive measures, in this exceptional situation in the country, due to the Covid-19 pandemic, it was decided :

Postponement of declarations and payments of social contributions to the (CNAS) for the month of April until May 3011’2020, instead of the legal deadline of April 30th, 2020; • Postponement of declarations and payments of social contributions to the (CASNOS) until September 30th,2020, instead of the legal deadline of June 30th ,2020; • Suspension for a period of (06) six months, of the accumulation of late payment and collection penalties (CNAS) on late declarations prior to April 2020; • Possibility of rescheduling previous debts in respect of CNAS and CASNOS contributions, for which payment may be made in installments; • Anticipation of annual holiday payments by the (CACOBATPH), instead of July/August 2020.

Banking measures

In view of the current health situation, the Bank of Algeria issued an instruction n°05-2020 of 6 April 2020 introducing exceptional measures to ease certain prudential provisions applicable to banks and financial institutions. According to this instruction, the following emerges:

- The minimum threshold of the liquidity coefficient, set by the provisions of Article 03 of Regulation No. 2011-04 of 24 May 2011 on the identification, measurement, management and control of the liquidity risk of banks and financial institutions, is reduced from 100% to 60%.

- Banks and financial institutions are exempt from the obligation to build up a safety cushion, set by the provisions of Article No. 04 of Regulation No. 2014-01 of 16 February 2014 setting the solvency coefficients applicable to banks and financial institutions at 2.5%.

- The Monetary Policy Operations Committee of the Bank of Algeria has put in place measures as from 15 March 2020:

– Reduce the reserve requirement ratio from 10 to 08% of the defined reserve base;

– Lower the Bank of Algeria’s key rate by 25 basis points (0.25%) to 3.25%.

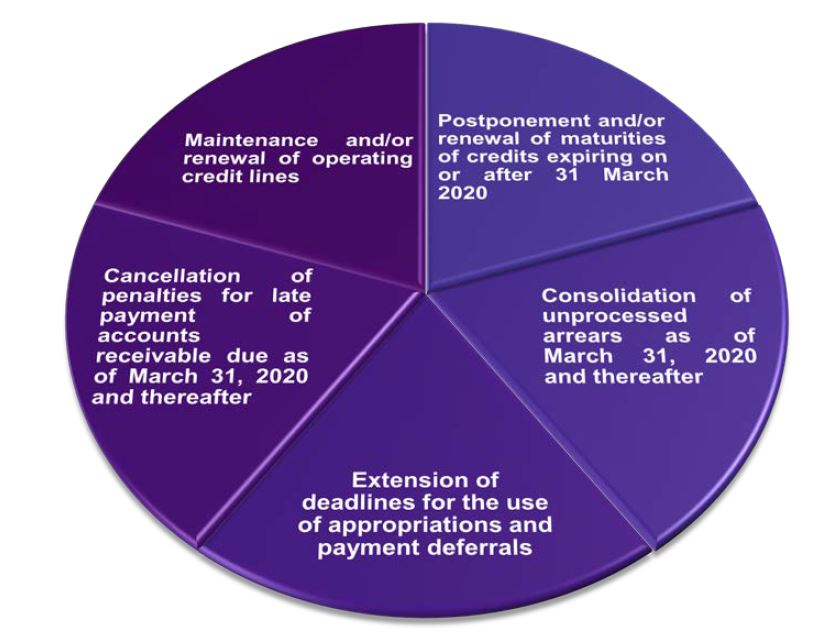

Range of banking measures

Labour law measures

Several measures and actions to prevent and combat the spread of this virus have been taken by the Government. These were introduced by Executive Decree No. 20-69 on measures to prevent and control the spread of the Coronavirus (COVID-19), then supplemented by Executive Decree No. 20-70 laying down additional measures to prevent and control the spread of the Coronavirus (COVID-19) and finally extended (to date) by Executive Decree No. 20-86 extending the provisions on measures to prevent and control the spread of the Coronavirus (COVID-19).

These provisions were recently renewed by Executive Decree No. 20-100 of 19 April 2020 renewing the system for preventing and combating the spread of the Coronavirus (Covid-19) until 29 April 2020 and from 20 April 2020 onwards.

The various above mentioned decrees have introduced a several exceptional measures, applicable to the entire national territory.

In this regard, the main mechanism highlighted, particularly by the Executive Decree No. 20-69, is the exceptional leave, through which employers should put at least 50% of their staff on exceptional paid leave, and this, during a period from March, 22th, 2020 to April, 19th 2020.

Custom measures

CI Green circuit for the customs clearance of certain products : The Directorate General of Customs has made available to professionals a list by tariff classification, listing the main categories of medical products, devices and instruments used in the prevention and fight against the spread of the virus, identified by their tariff subheadings. This list aims at constituting a reference of tariff classification of the above-mentioned products in the customs tariff, as well as to contribute to bring facilitations to the customs agents as well as to the forwarding agents, within the framework of the establishment of the formalities of customs clearance relating to it.

In addition, the clearance of these goods will benefit from the green circuit procedure, which is designed to allow for accelerated clearance and removal.

To this end, it will be up to the customs services to accept, as part of the customs declaration, the declarants’ letters of undertaking, accompanied by the transport documents, to make the declaration in detail and to complete the customs clearance formalities, including the payment of duties and taxes, after removal of the goods.

The Ministry of Labor, Employment and Social Security has authorized employers, by means of a communiqué, to proceed with the payment of social security contributions at the level of all agencies throughout the national territory, without having to go to the agencies to which they depend. Thus, from March 22″1,2020 and until further notice, employers will be able to deposit their cheques or notices of payment of social security contributions at each structure under the authority of the Caisse Nationale des Assurances Sociales des Travailleurs Salaries (CNAS), whether it is a payment center or a collection department.